modified business tax nevada due date

Q4 Oct - Dec January 31. If you have any lingering questions we encourage you to call our Sales Information team at 800 536-1099 or review.

State And Local Tax Salt Roadmap And Resource Center Resources Aicpa

The Nevada Commerce Tax return is due 45 days following the end of Nevadas fiscal year which ended on June 30 2020.

. Generally the due date is August 14. In Nevada the Modified Business Tax is imposed on all businesses with payroll in. Nevada Commerce Tax Rate.

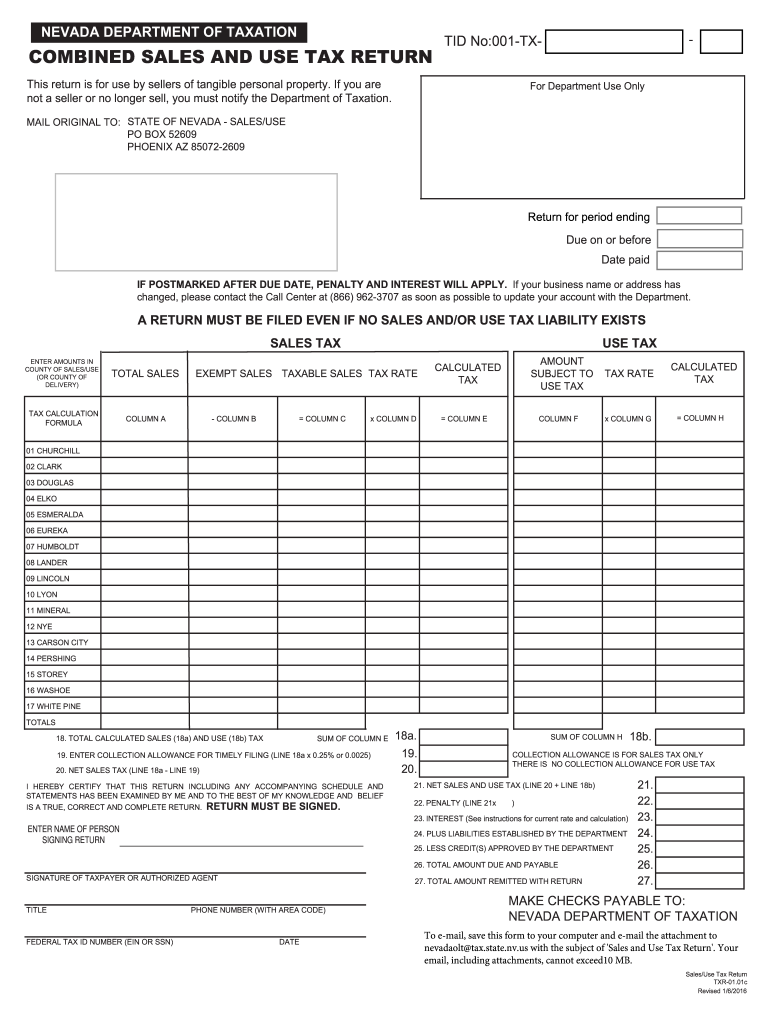

4142004 82838 PM Document presentation format. Forms and payments have to be mailed or hand delivered to one of the four district offices of the Nevada Department of. When youre ready to buy you can do so at any time and from anywhere.

PREVIOUS DEBITS Outstanding liabilities 16. All monthly tax returns due on or before June 30 2020. On-screen Show 43 Company.

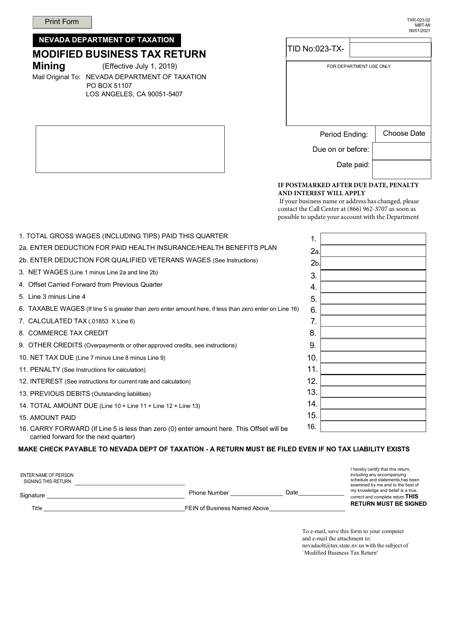

Nevada Modified Business Tax Rate. Poor Richard Wingdings Copperplate Gothic. Modified Business Tax Return-Mining 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the tax on the Net.

Due Date Extended Due Date. When is the Nevada Modified Business Tax due. The Commerce Tax return is due 45 days following the end of the fiscal year.

Music in this video we will show you how to file a sales and use tax return once you have logged in go to filings in the left menu list if you manage more than one business you will need to. Q2 Apr - Jun July 31. According to the court a.

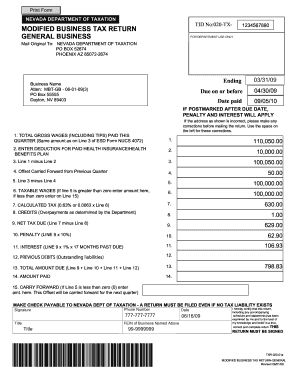

For example the tax return and remittance for. State of Nevada. Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as defined by.

Tax for each calendar quarter is due on the last day of the quarter and is to be paid on or before the last day of the month following the quarter. When the Nevada Revenue Plan was adopted back on May 31 2015 by the Nevada Legislature it altered the landscape of business taxes within the state. Q1 Jan - Mar April 30.

Get the up-to-date nevada modified business tax 2022 now Get Form. The Commerce Tax return is due 45 days following the end of the fiscal year. All quarterly tax returns due on or before April 30 2020.

48 out of 5. The default dates for submission are April 30 July 31 October 31 and January 31. Nevada Department of Taxation PO Box 7165.

TOTAL AMOUNT DUE Line 12 Line. Nevada modified business tax due dates by Jan 24 2021 cartoon concept science The 2011 Legislative Session pursuant to AB 561 eliminated the Modified Business Tax on any General. The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019.

The tax was due and payable on or before 6302020 which includes. The due dates are April 30 July 31 October 31 and January 31. Forms and payments must be mailed to the address below.

Modified Business Tax Statistics Please note the following figures are based on tax-paying businesses only and are not a complete representation of total Nevada gross wages Quarterly. The package increased annual. Who needs to pay the Nevada Modified Business Tax.

Nevada Commerce Tax due August 14 2020. Q3 Jul - Sep October 31. Business tax general business Returns are due by the last day of the month following the calendar quarter in which the employer is required to pay Unemployment.

NevadaTax is our online system for registering filing or paying many of the taxes administered by the Department. If your business ends up with a gross annual revenue over 4 million then your business will pay the Nevada commerce tax. With it you can manage your own tax account anytime anywhere and without.

The tax is imposed on businesses with a Nevada gross revenue exceeding 4000000 in the taxable year. If your company paid Nevada Commerce Tax and has its payroll concentrated outside Nevada it should consider filing a refund claim for the tax year ended June 2019 by the July 31 2022. If the due date falls on a weekend or holiday the return is due on the next.

State Of Nevada Department Of Taxation Ask The Advisors Basic Tax Academy Ppt Download

Employers To Receive Refunds Of Overpaid Nevada Modified Business Tax

Sales Use Tax Nv Fill Out Sign Online Dochub

Nevada Department Of Taxation Forms Pdf Templates Download Fill And Print For Free Templateroller

Have You Not Collected Or Remitted Your Nevada Sales Tax Yet Consider The Voluntary Disclosure Program Sales Tax Helper

How To Form An Llc In Nevada For 49 Nv Llc Formation Zenbusiness Inc

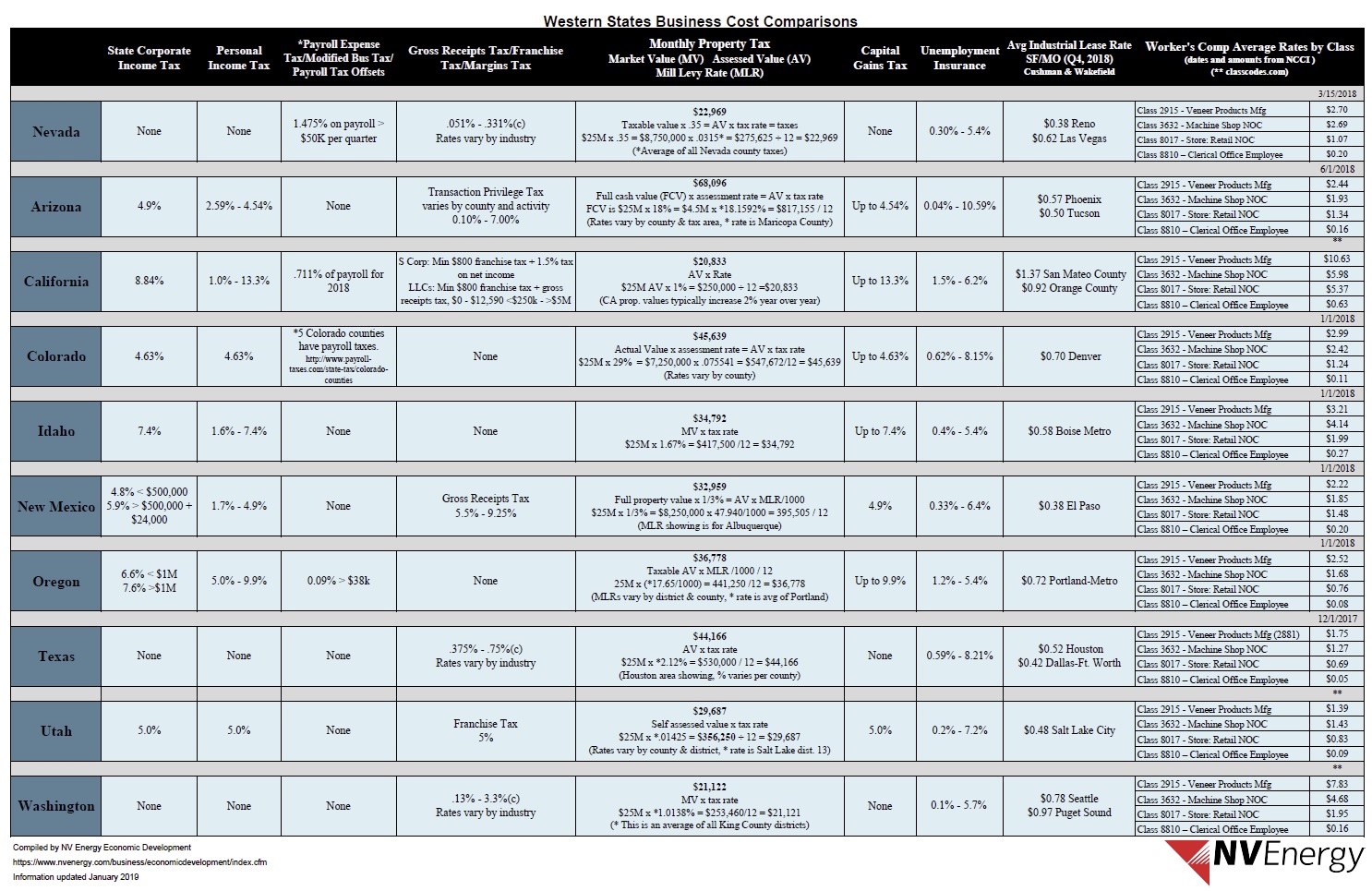

Nevada Taxes Incentives Nv Energy

Modified Business Tax Form Fill Out Printable Pdf Forms Online

Nevada Commerce Tax What You Need To Know Sage International Inc

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

Nevada Department Of Taxation Announces Amnesty Program Dates Eligibility Criteria Klas

Form 1120 Fill Out Sign Online Dochub

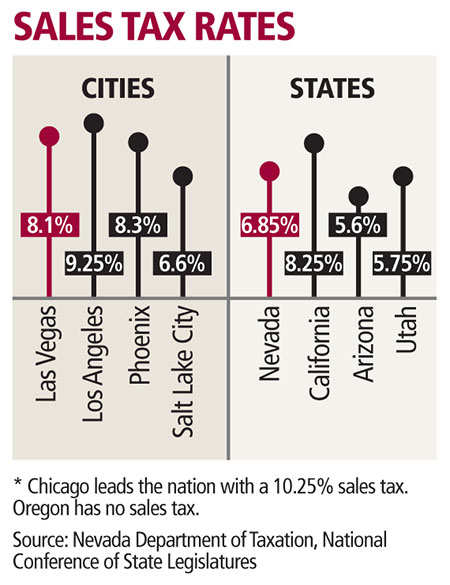

Taxes About To Increase Las Vegas Review Journal

2023 State Business Tax Climate Index Tax Foundation

Carson Valley Accounting Referral Policy

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

How To Form An Llc In Nevada For 49 Nv Llc Formation Zenbusiness Inc

Nevada Modified Business Tax Form Fill Out And Sign Printable Pdf Template Signnow